So, rates have gone up! (Duh, everyone knows that…) But, I’m going to make a BOLD prediction…Rates will be down again within about 6 months! Here’s why I think this is… (hear me out)

Simply put, rates track inflation. Inflation has risen. So, rates have risen. But…now we see inflation tapering off…so what? In fact, when the recent inflation report showed inflation coming down, we saw the sharpest one-day drop in the average rate on the 30-year fixed mortgage since daily record-keeping began in 2009. So, let’s dig in more to see the various factors…

First of all, how did we get here in the first place? Well, the high inflation levels were due mostly to 3 key factors:

- Excess Demand

- Supply Constraints

- Money Supply Increases

Let’s break each of these down and see how things are changing. Hint, there is good news re: inflation levels! (and, remember,,,as inflation comes down, so do rates.)

demand is down

Demand for goods went crazy during the pandemic when people were hunkered down in their homes and had money to spend, thanks to the massive Federal stimulus packages. Well, we’re now seeing demand decreasing and even deflation with many durable goods. Why? Simply put: Because people can’t afford as much. There are 3 main reasons for that:

- Those stimulus checks have dried up, and that money pushed into the economy has now mostly been spent.

- The higher rates from the FED have made money more expensive to borrow.

- The rate of inflation has actually surpassed wage growth.

One thing that is interesting is that we’re starting to see consumers make different spending choices. For example, Walmart (America’s biggest retailer) reported that 75% of their grocery market sale gains came from people earning over $100,000/yr — aka, even those earning more than the median are moving away from other more expensive stores like Whole Foods.

Supply Is up

The supply chain issues we saw in the height of the pandemic have gotten much better, which means goods are much more readily available now. No more waiting 6 months for your dream couch! The same is true for things like lumber, chips, consumer goods, etc.

In fact, at one point in 2021, the shipping container backup in LA stretched ~60 miles!! Holy moly! Now, it’s almost back to normal…on Oct 20, the WSJ reported that there were only 4 ships waiting at the LA Port.

So, supply is up and demand has fallen…there’s an imbalance that is opposite what we saw during the pandemic.

the money supply is drying up

The money supply was massively increased by all the Fed stimulus, which we know has now ended. Plus, it’s looking more and more like we’ll have a gridlocked government following the midterms. AKA big spending bills will be harder to get passed. With less money being poured into the economy, the government will soon be looking for alternative ways to inject cash into the economy. So, if they aren’t injecting money into the economy, they can keep us spending by lowering rates back down.

And…if I haven’t bored you to tears yet…here’s another interesting data point:

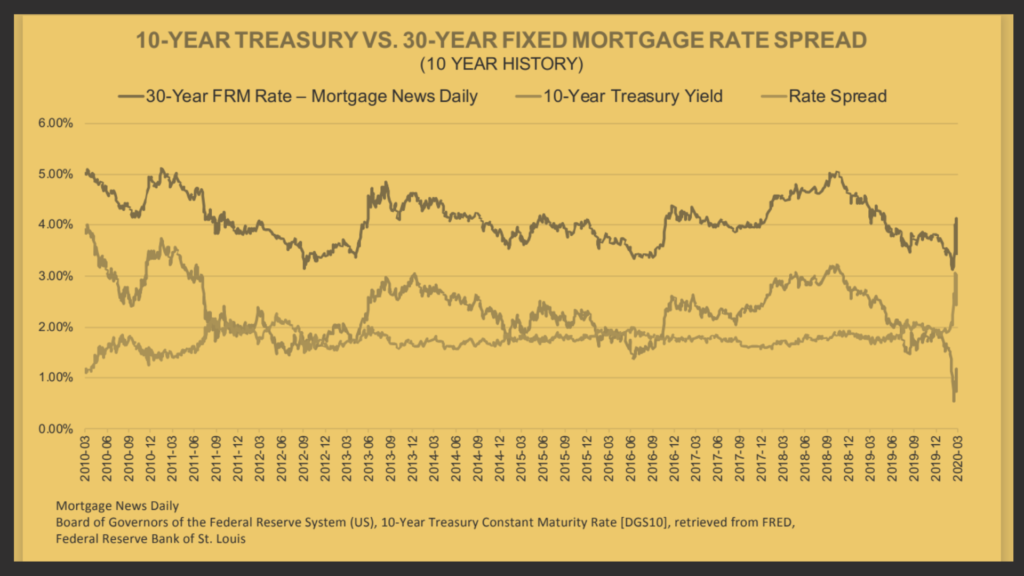

The spread between the 30-year mortgage rates and the 10-year Treasury, has widened to levels not seen since March 2020 and December 2008. During both of those times, mortgage rates declined significantly the following year.

Take a look:

Think I’m crazy? I’m not alone in thinking this. Here are a few others who are as convinced as me:

Barry Habib

(winner of 3 Crystal Ball awards, aka the Oscar for Real Estate forecasting)

Lacy Hunt

(Internationally known economist and a Fed expert)

Jeff Snider

(one of the foremost experts on the global monetary system)

Stephanie Pomboy

(founder of economic research firm MacroMavens)

TL;DR:

Rates will very likely fall below 5% (or 4% for jumbo) within 6 months, making homes more affordable and giving great refi opportunities (YAY!). But, beware…this will also spark more demand…