Say what? Let me explain…

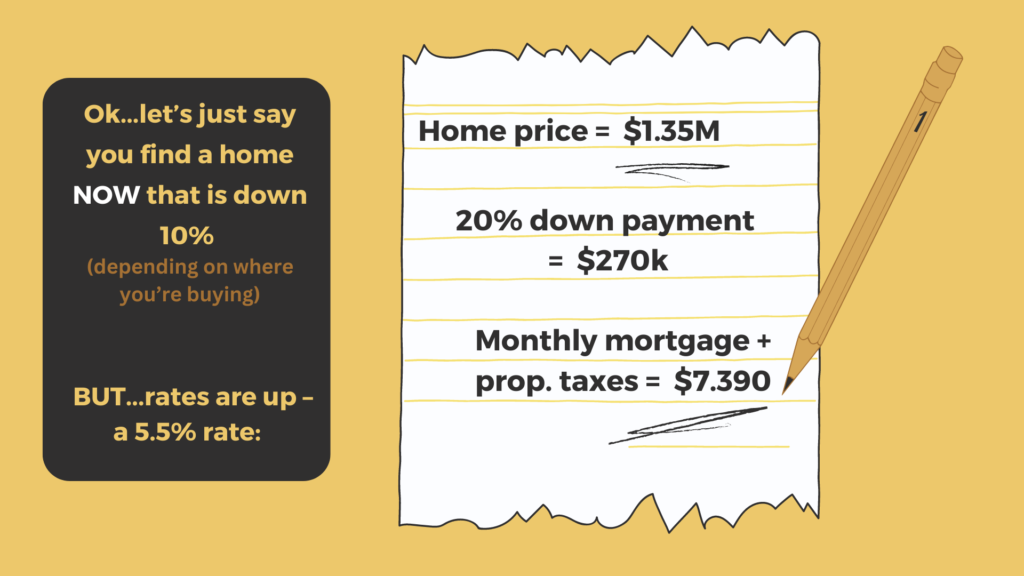

Everyone knows that mortgage rates are up, up, up. BUT…because some buyers have shied away from the higher rates, competition is also down (aka prices are down a bit)

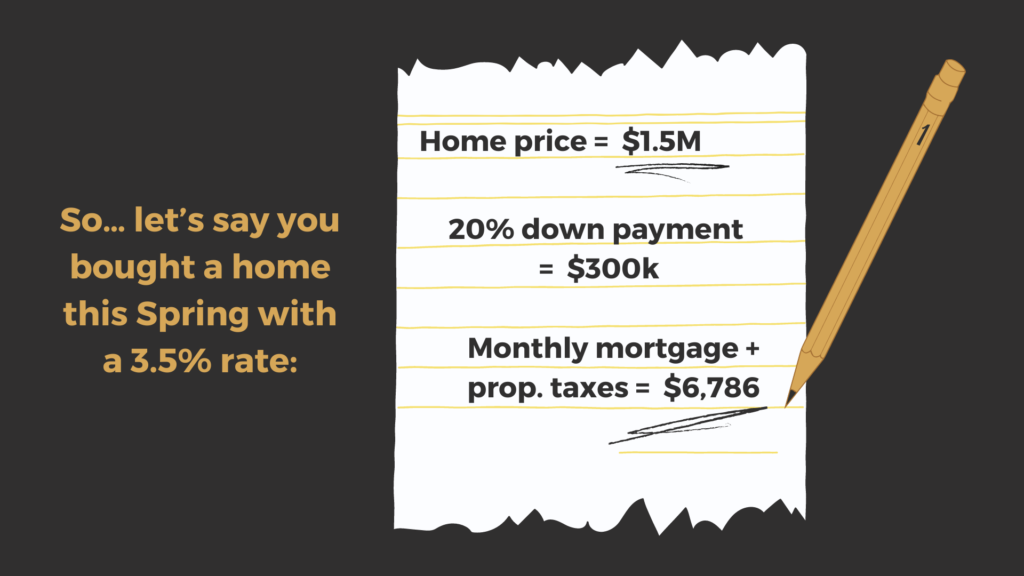

(Side note…Keep in mind that a good chunk of that is tax deductible!)

$6,786 vs $7,390 → Today, with the higher rate, you’re paying ~$600 more per month.

(so…umm…how is this better?!?)

Well, with the difference in down payment and closing costs (which are based, in part, on the purchase price), you save ~$34k in cash. (It would take almost 5 YEARS to make up that delta in monthly payment.)

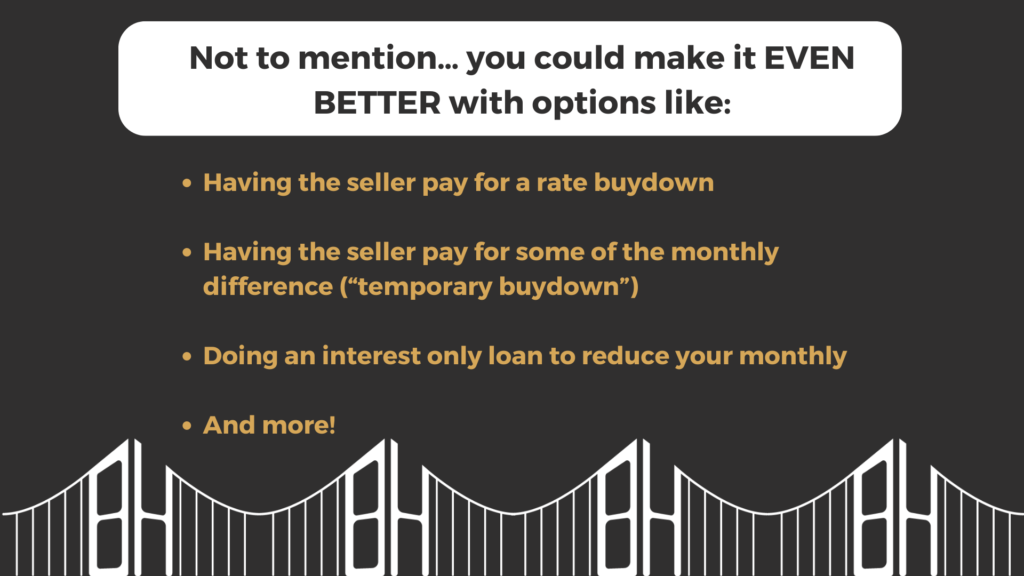

Plus, we believe rates will be down within the next year. When you refi, you can bridge that monthly delta even more – and you still saved the cash!

Sound like an opportunity to you?

Facebook

Twitter

LinkedIn