Happy (belated) Mother’s Day to all mothers, soon-to-be mothers, and fur-baby mothers! Hope you had a wonderful weekend.

The theme of this report is “reopening.” I mean… to go outside and not have to wear a mask… say what?! It’s hard to believe we can start seeing friends and family, traveling, and getting back to some normalcy. But, what does a post-Covid world really look like, from a real estate perspective?

First, let’s look back: One year ago, in May of 2020, transaction volume (# homes sold) bottomed out in SF (there were only 26 sales in SF, one of the lowest points we’ve ever seen in what is typically a very busy month).

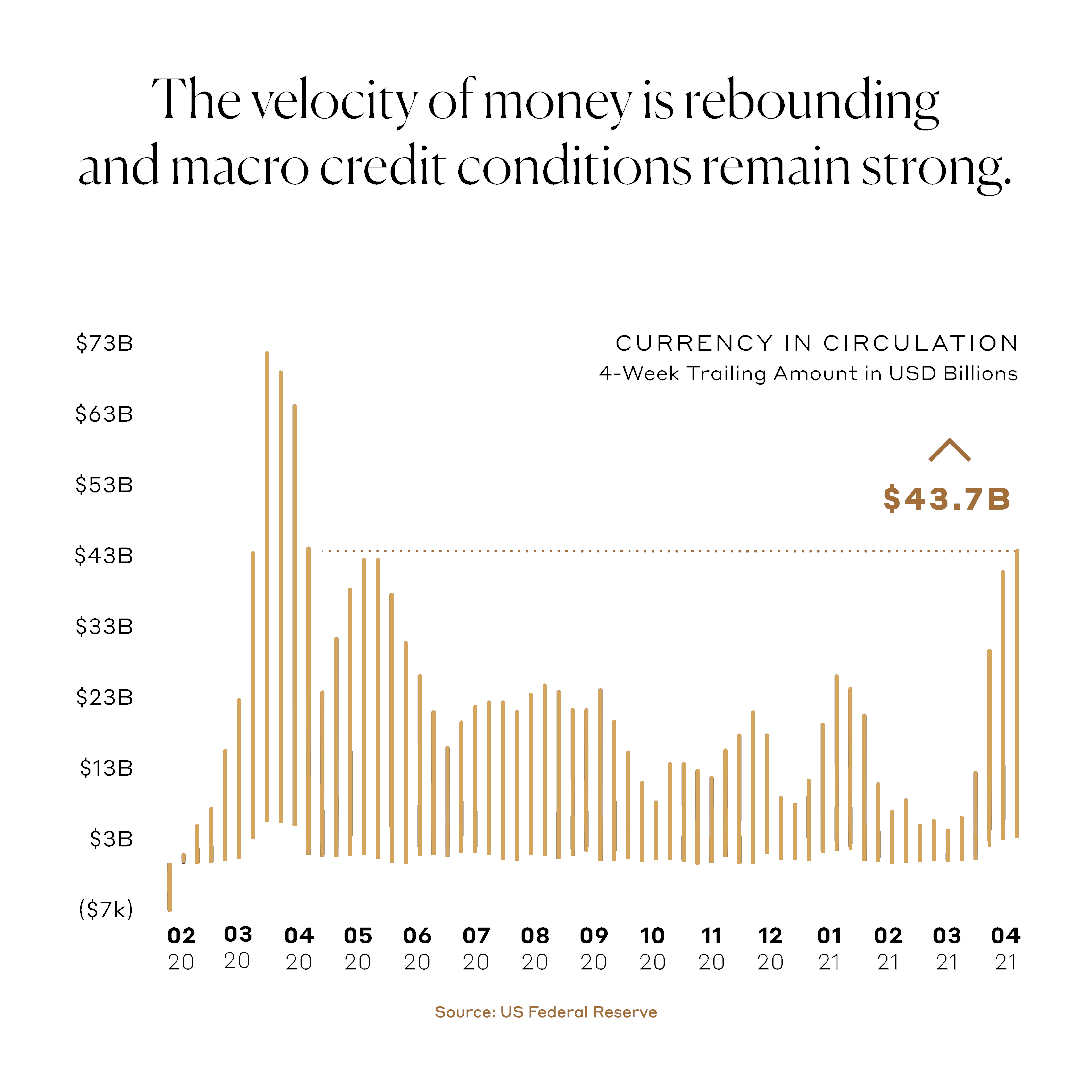

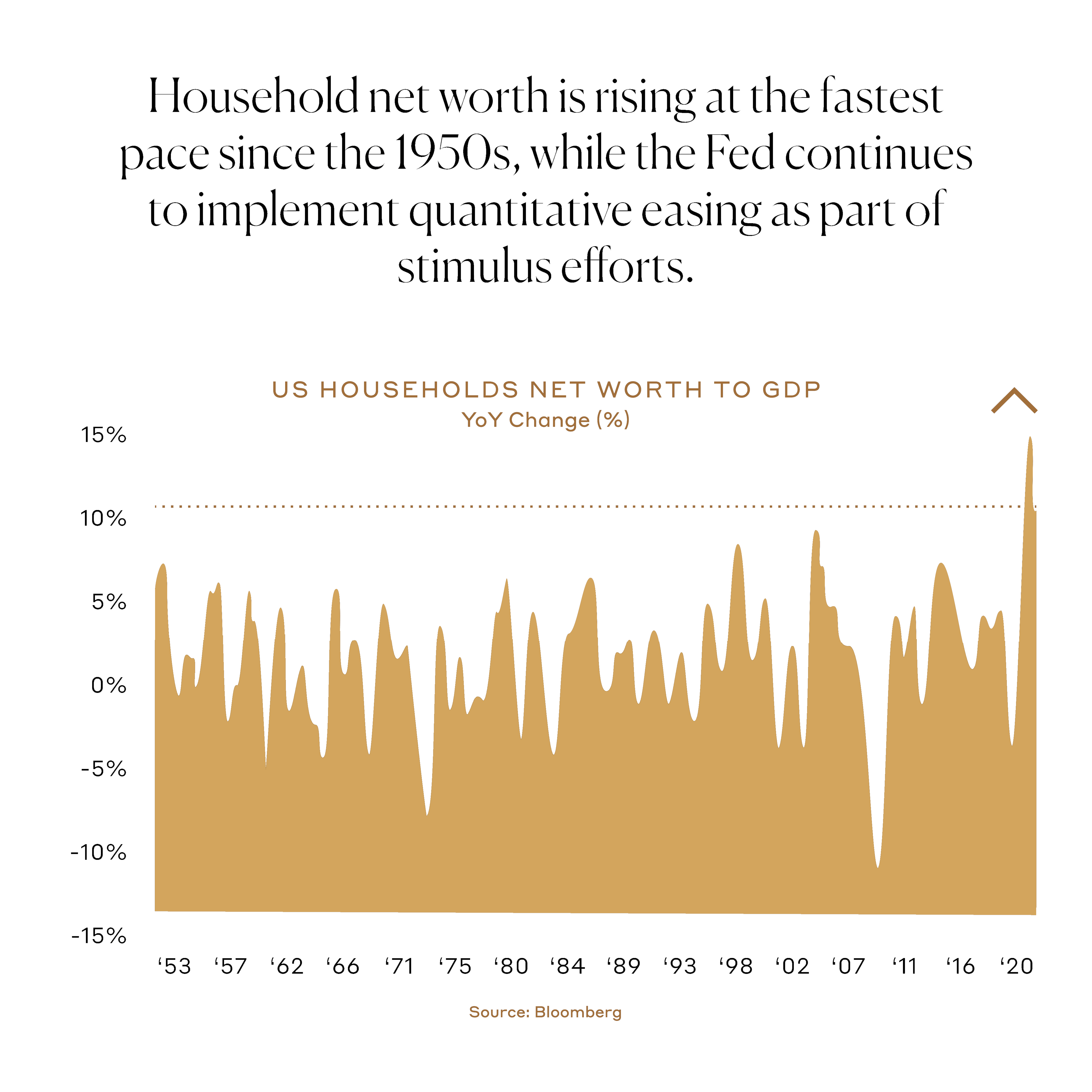

Fast forward to today, and things are very different. From a macro level, people are spending money again, and, at the same time, consumer defaults are on the decline (unlike what we saw in the Financial Crisis). Household net worth is rising at the fastest pace since the 1950s — in part, because people haven’t had anywhere to spend money and, in part, because of inflationary tendencies. A lot of this wealth creation is actually driven by hard assets, including things like real estate, silver, and lumbar.

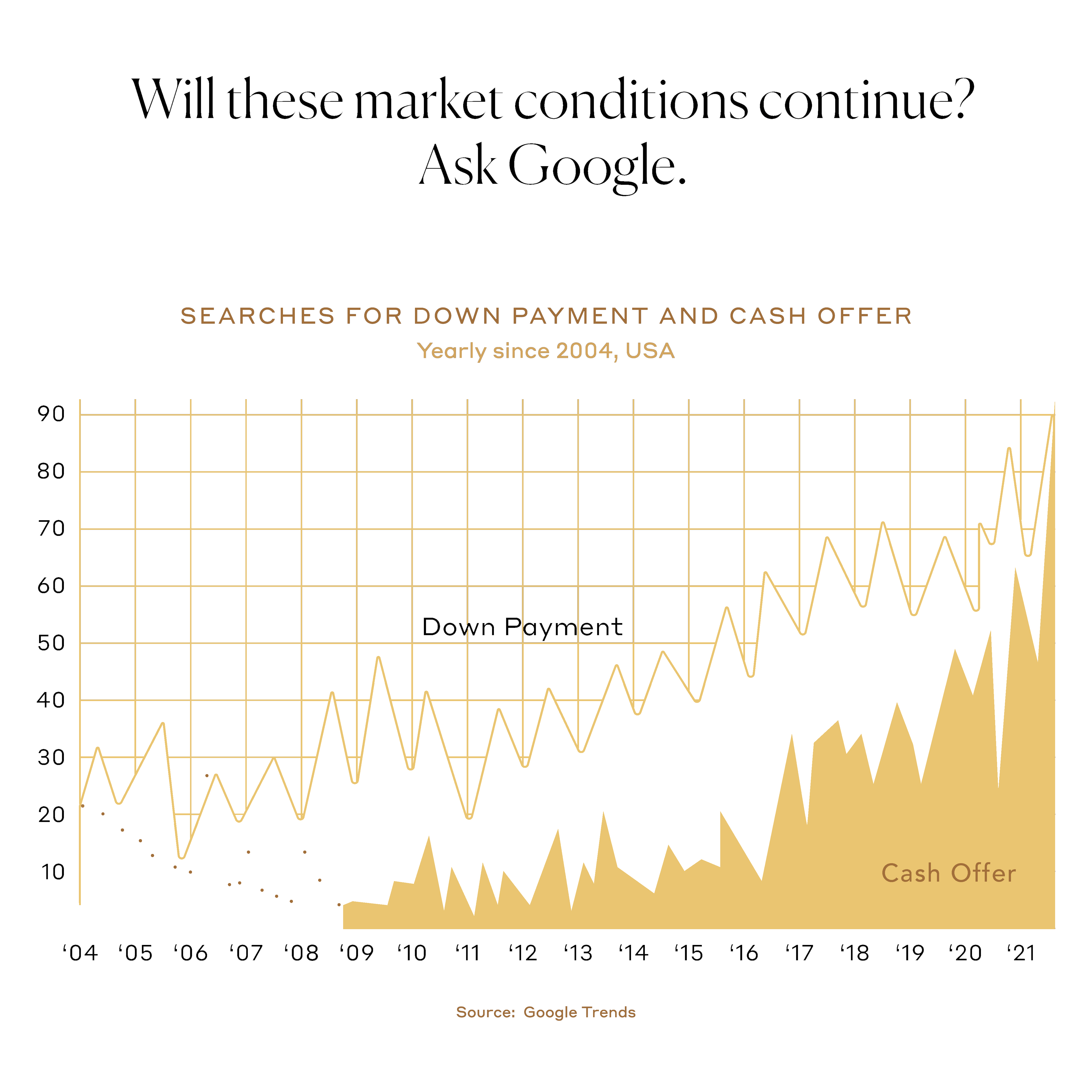

The other day, someone asked me if I thought that we were in a “Real Estate Bubble.” I thought about it for a bit, and concluded that I firmly do NOT believe that we are. One primary reason is that real estate has always been a hedge against inflation, something that is being talked about a lot these days. While real estate is a great investment at just about any time (tax benefits, appreciation potential, scarcity of land, etc.), it is even better during times of rising inflation.

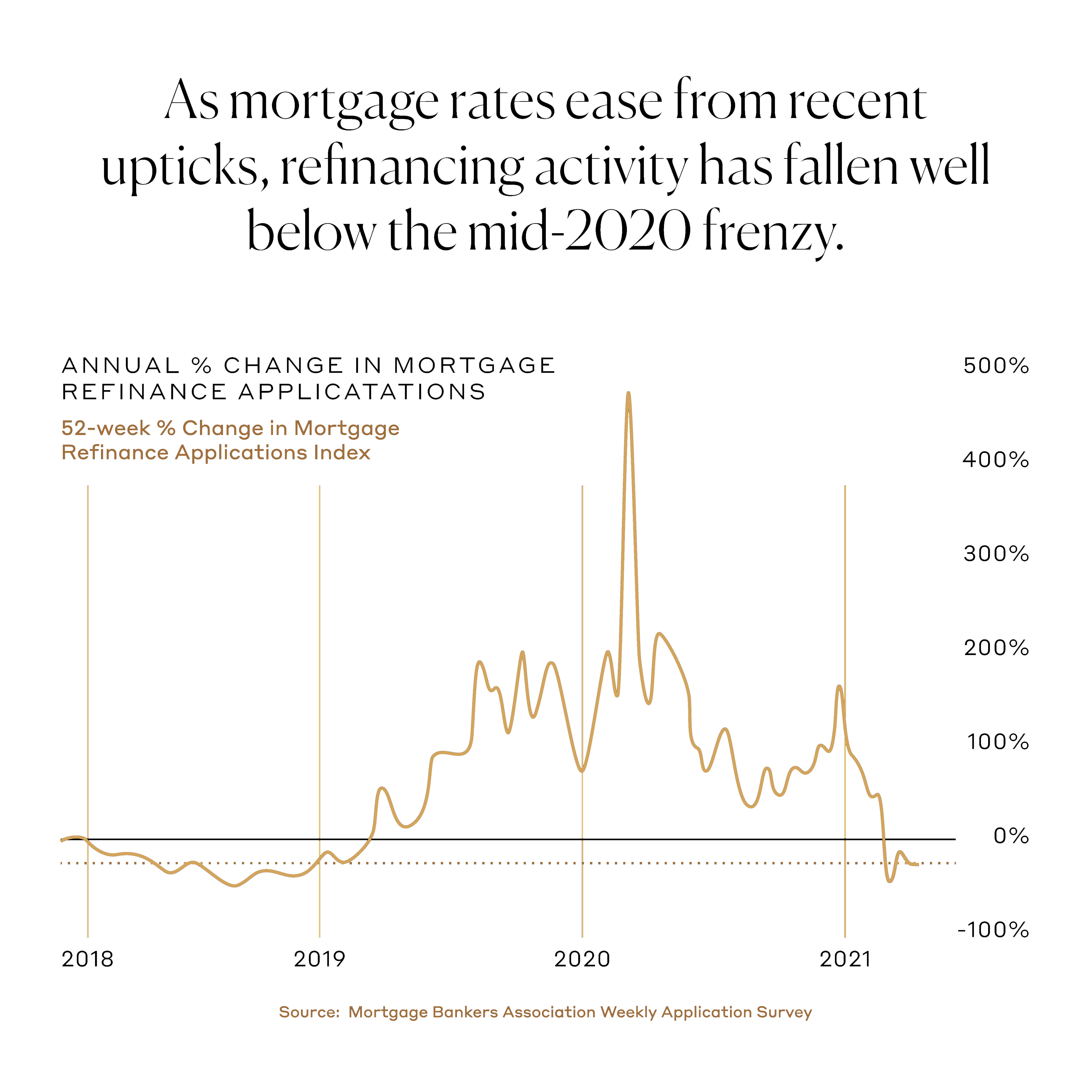

So far this year, there have been some interest rate increases, which has lead to a decline in the re-fi market, but — interestingly — it’s led to a further increase in new home purchases as people try to lock in these low rates before they rise further. It is crazy how a modest change in the rate can impact your affordability quite significantly!

In other news, Mark Benioff announced that employees could start to come back into the office, starting NEXT week. Traffic is noticeably picking up, and the life of our communities is returning! It will be a very interesting next few months. In the meantime, enjoy the data below.

And, as always, let me know if you’d like to geek out more on the data and what it might mean for you.

Best,

Blakely

🇺🇸