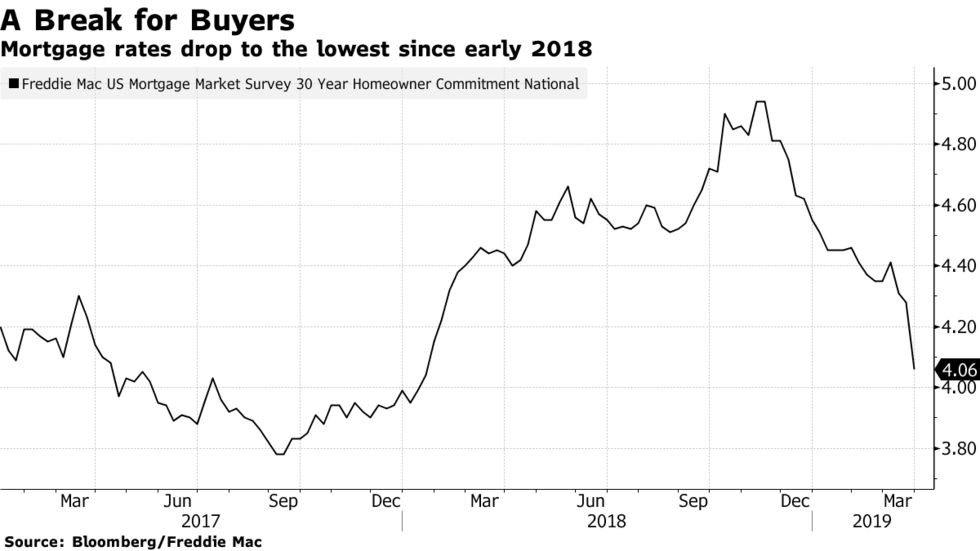

- The 30-year average drops to 4.06%, lowest in more than a year

- Decline is giving a boost to the slowing U.S. housing market

U.S. mortgage rates fell by the most in more than a decade, giving homebuyers a crack at the lowest loan costs since early 2018. The slowing housing market could use the boost.

The average rate for a 30-year loan was 4.06 percent, down from 4.28 percent last week, Freddie Mac said in a statement Thursday. The decline was the biggest since December 2008. The average 15-year rate dropped to 3.57 percent from 3.71 percent.

The housing market, damaged by a spike in mortgage rates last year that cut into affordability, is signaling that it’s getting some strength back. Two publicly traded builders, Lennar Corp. and KB Home, credited lower rates for better-than-expected home orders. And mortgage applicationsfor purchases rose 4 percent last week from a year earlier, according to the Mortgage Bankers Association.

While strong job growth will help, buyers may have less confidence in the economy after a recent drop-off in stocks and headwinds gathering from Europe and China. The Federal Reserve cut its outlook for growth this year and next and forecast no interest-rate hikes for 2019.

Don’t expect lower mortgage rates to spark a surge in demand, but something more like a “stabilization,” said Robert Dietz, chief economist of the National Association of Home Builders.

“We saw an adjustment in the fall, now we’re getting a reprieve,” Dietz said.